Extra payroll benefits to empower your employees

Simplify your salary and wage disbursements and connect your workforce to a market place of financial value-adding services.

Overview

Save time.

Improve accuracy

Disbursing salaries has never been easier.

With our payroll platform, you can easily manage salary disbursements, remit statutory payments, and access insightful analytics for organisational forecasting and planning.

Breeze ahead the talent retention curve

With the Barizi Payer Earned Wage Access platform, your people can:

- Easily access their salaries before payday.

- Manage financial emergencies without paperwork and at a lower cost.

- Build credit history, which can facilitate access to larger loans with longer tenor.

- Enjoy peace of mind and become more productive on the job.

And as an employer, you enjoy:

- Greater productivity and profitability.

- Reduced staff turnover.

- Reduction in staff pilferage.

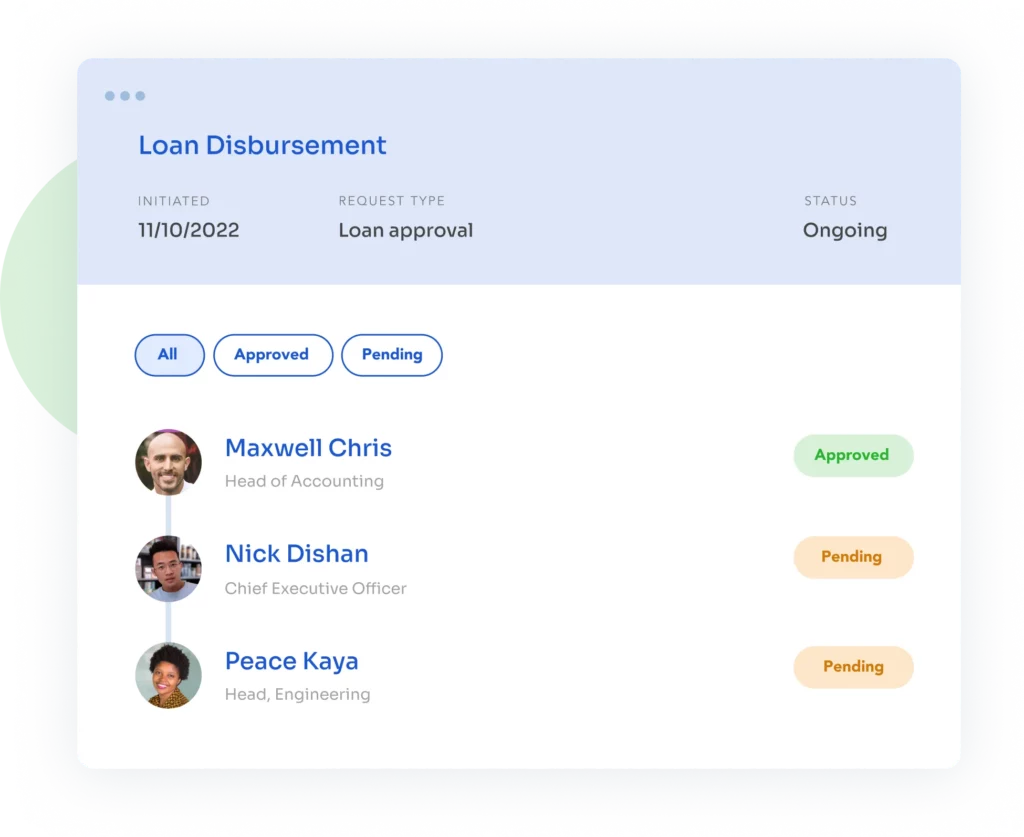

Invest in your employees’ future.

Happy employees make happy workers.

Help your employees achieve financial freedom with easy access to loans with competitive interest rates, as well as convenient and straightforward repayment plans.

Frequently Asked Questions

Earned Wage Access is a salary/wage-on-demand service designed for income earners to facilitate instant access to income earned by an employee before pay day.

It works as follows:

- The Employer is onboarded on the Barizi Payer platform, designed for seamless payment of wages/salaries.

- The Employee receives one, two- or three-month’s wages/salary from the employer through the platform, as configured.

- In any subsequent month, the employee profiles himself/herself for Earned Wage Access by providing personal details and setting up a preferred Personal Identification Number (PIN) on the Barizi app.

- A profiled employee logs on to Barizi or other dedicated e-channels to request a desired portion of earned income during the month.

- Upon successful validation of request, the salary account of the applicant is credited instantly.

- On payday, the salary/wage of the beneficiary is deducted at source for an amount equivalent to the sum of the income advanced & the service charge, and the balance paid the employee.

The Employee can access up to 90% of earned income in advance of payday. This is however configurable and different employers may have varying employee welfare requirements, risk appetites and guardrails.

An employee can access Earned Wage Access up to thrice a month.

Yes, the Service charge is banded, based on the amount requested.

No, the Service Charge is payable only in the month an employee enjoys/accesses the Earned Wage Access service.

No, it is required that I would have worked for a minimum of 1 week after payday to be eligible for Earned Wage Access. In addition, requests after a specific payday must be in the month next to the payday.

Pricing considerations are ongoing. Expect updates here soon.

A monthly default charge of 1% of the sum of the Advanced Income and Service Charge shall apply in the event of default. Scenarios like accessing earned wage through our platform and absconding from the workplace before month-end constitute a default that the Employee is accountable for.

Your obligation will be converted to a loan if it is not repaid after 1 month of default and the usual loan recovery process, including the triggering of CBK’s approved recovery mechanisms and eventual Credit bureau blacklisting shall apply.

- 36, Othaya Road, Nairobi, Kenya

- +254 742 495402

- embeddedfinance@seamlesshr.com